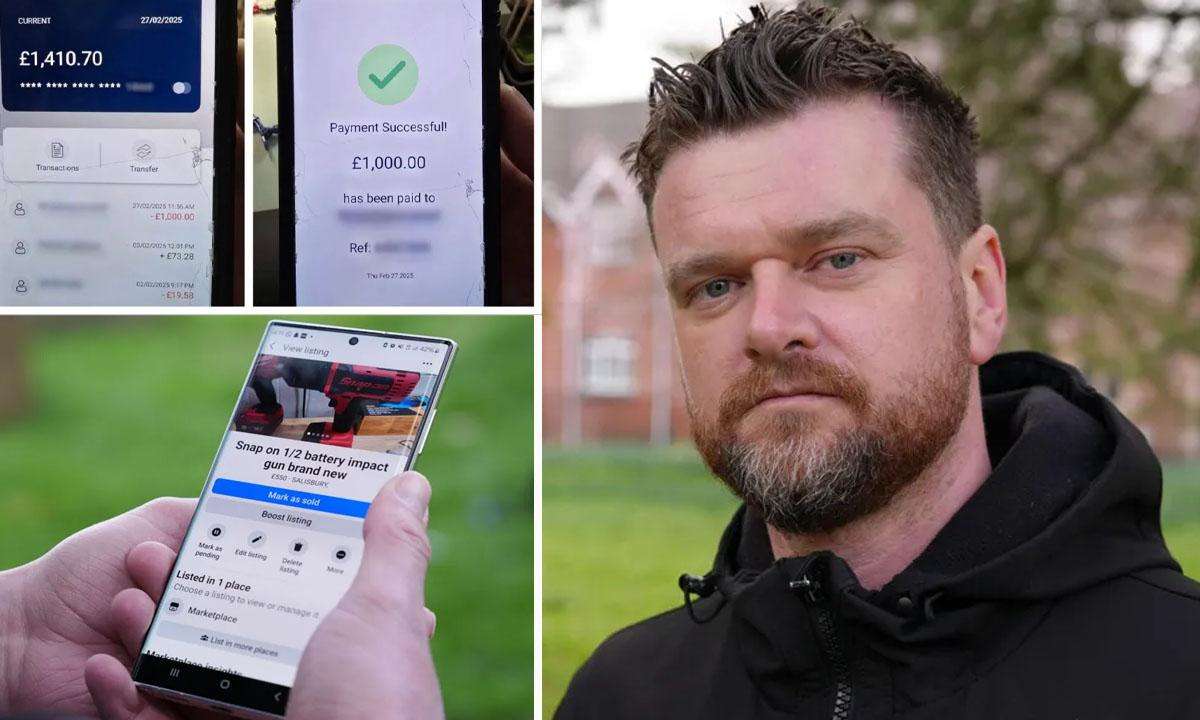

A man who was conned out of £1,000 worth of tools through a fake banking app has said the experience left him feeling like he’s “lost faith in humanity.”

The scam involves counterfeit apps that closely mimic real banking platforms. These fraudulent apps can display convincing "successful payment" messages, tricking sellers into thinking a bank transfer has been completed. The scammers then walk away with the goods, leaving the victims out of pocket.

Dr Tim Day, who leads on doorstep crime and scams at the Chartered Trading Standards Institute (CTSI), called the scam an "emerging threat" and noted that the face-to-face element makes it particularly unusual.

Anthony Rudd, one of the victims, said: "It made me feel sick that someone could look you in the eye, shake your hand, and then steal from you."

There have been around 500 reported incidents of fake banking app scams to Action Fraud over the past three years.

Some of these apps were previously available on the Google Play Store but have since been removed. A Google spokesperson stated that “user safety is our top priority.” However, a BBC West investigation discovered that similar apps are still being circulated online and can be directly installed on Android devices without needing an app store.

Mr Rudd, a mechanic, had advertised over £1,000 worth of power tools on a social media platform. He was contacted by someone using the name Liam Wright, who arranged to visit his workshop in Salisbury, Wiltshire.

The buyer inspected the tools, offered to pay via bank transfer, and showed what appeared to be a genuine banking app. Mr Rudd entered his account details into the app himself, saw a successful payment message, and believed the money was on its way.

But while he turned around to collect some accessories, the scammer took the tools and left. The payment never arrived.

“He came into my workplace and just walked off with my tools,” Mr Rudd said. “I was furious – not just because of what he did, but because I let it happen.”

The emotional toll led Mr Rudd to resign from his job, saying the scam deeply affected his mental health. "You start to lose faith in people," he said.

Wiltshire Police told him they would not be pursuing the case further as they were unable to identify the suspect from the February 11 incident.

Another victim, John Reddock from Liverpool, shared a similar experience. He was selling a gold bracelet for £2,000, hoping to use the money to take his children on holiday to Spain.

Two men responded to his ad and came to his house. They agreed to buy the bracelet and appeared to make a payment using what looked like a banking app. Once again, a payment confirmation was shown — but no money ever reached Mr Reddock’s account.

“They just came to my house and stole from me,” he said. “It’s been keeping me up at night. I was trying to do something nice for my kids, and now I feel robbed and betrayed.”

Although he reported the scam to the police, no further action was taken in his case either.

BBC West found that the fake apps – which they declined to name – are still accessible online and can be installed onto Android phones without going through official platforms.

Dr Day warned that because so many scams are now digital, people tend to let their guard down when dealing with others face-to-face.

“This kind of scam feels more believable because it happens in person,” he explained. “But fraud is evolving — it's getting more advanced and harder to detect.”

He added that fraud is becoming increasingly attractive to organized criminals because of the high profits and relatively low risk of enforcement. He also urged technology companies to take a more active role in fighting fraud on their platforms.

.svg)