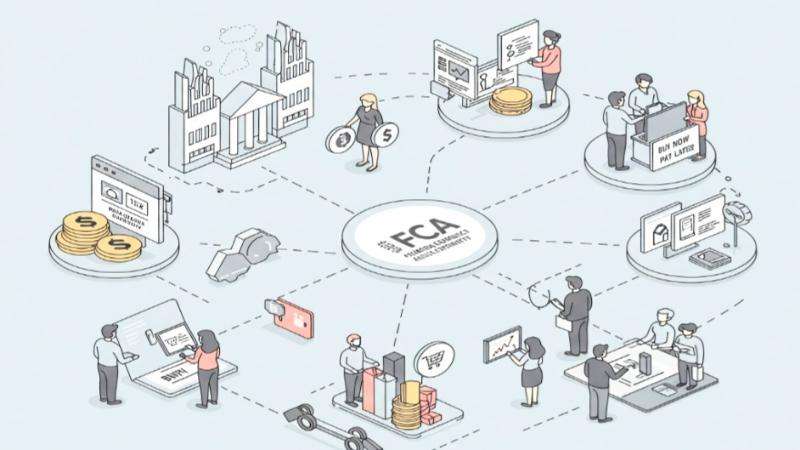

After years of anticipation, the UK government is finally set to unveil legislation to regulate the burgeoning "buy now pay later" (BNPL) sector. Financial services providers, including major players like Klarna and Clearpay, will now fall under the purview of the Financial Conduct Authority (FCA), ushering in an era of greater scrutiny and consumer protection.

The new rules will mandate that BNPL firms conduct thorough affordability checks on borrowers, aligning their practices with established banking standards. This move aims to prevent consumers from falling into debt traps, a concern highlighted by consumer groups such as Citizens Advice, which reported that BNPL schemes have contributed to individuals struggling to pay essential bills.

Furthermore, the upcoming legislation will empower borrowers with the ability to lodge complaints with the Financial Ombudsman, providing a crucial avenue for dispute resolution. Consumers will also benefit from faster access to refunds, enhancing their rights and protections within the BNPL ecosystem.

City minister Emma Reynolds emphasized the significance of these changes, stating, "These new rules will protect shoppers from debt traps and give the sector the certainty it needs to invest, grow and create jobs. Buy now pay later has transformed shopping for millions, but for too long has operated as a wild west — leaving consumers exposed."

The journey towards regulating the BNPL sector has been protracted. Initial plans were announced in 2021, with the previous government suggesting implementation in 2023. The fact that approximately 11 million people in the UK have utilized BNPL services underscores the urgency and scale of this regulatory intervention.

Consumer advocacy groups have welcomed the government's action. Tom MacInnes, director of policy at Citizens Advice, urged the FCA to "act swiftly to set out the strong consumer safeguards that are so urgently required."

Leading BNPL providers have also expressed their support for regulation. A spokesperson for Klarna stated, "It’s good to see progress on regulation, and we look forward to working with the FCA on rules to protect consumers and encourage innovation." Similarly, Clearpay affirmed its commitment to supporting regulation that fosters "much-needed innovation in consumer credit" and bolsters the UK's fintech industry.

The government's move comes on the heels of an FCA report revealing that a significant portion of the population is grappling with financial strain, with one in ten individuals unable to meet essential bill payments. The report also highlighted the widespread adoption of BNPL products in recent years, further underscoring the necessity for robust regulatory oversight.

_4.jpg)

_2.jpg)

_2.jpg)

_3.jpg)

.svg)

_3.jpg)