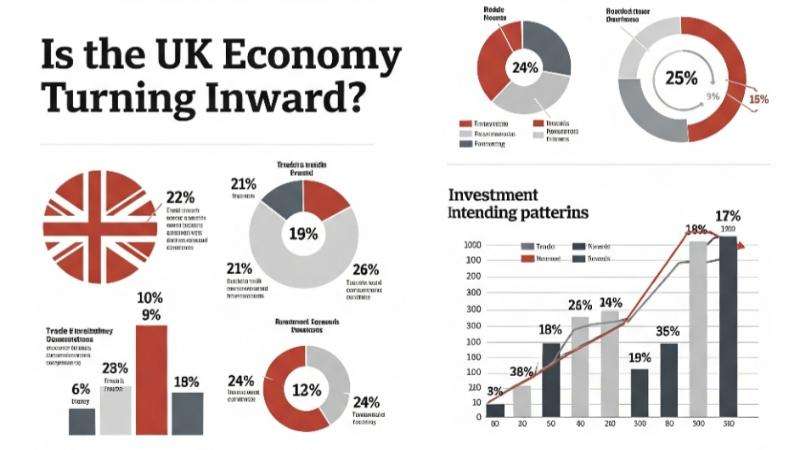

The bedrock of the UK economy, its financial services sector, is flashing red warning signs, pointing towards a challenging period ahead marked by accelerated job losses, curtailed investment, and a palpable dip in optimism. This somber outlook, revealed in a recent Confederation of British Industry (CBI) survey, presents a critical juncture for the nation's economic trajectory, even as a separate Deloitte report hints at a surprising resurgence in domestic investment appeal, Daily Dazzling Dawn understands.

According to the CBI, activity across the financial sector plummeted in the three months to June, experiencing its sharpest decline since December 2023 and marking the first decrease in over a year. Banks, in particular, bore the brunt of this downturn, with output dropping significantly. This contraction has immediate implications for employment, as firms are not only reporting a fall in current staffing levels but also bracing for a more rapid pace of job cuts in the upcoming quarter. This aligns with broader cost-cutting efforts by squeezed UK businesses, who anticipate a modest improvement in profitability stemming from these headcount reductions.

Investment plans are also taking a hit. Financial firms expect a notable reduction in capital expenditure over the next year, especially in areas like land, buildings, and machinery. The primary culprit cited for this reluctance is weakening demand, though a volatile economic climate, regulatory pressures, and tax measures introduced in the autumn budget are also weighing heavily on spending decisions.

Optimism among financial services businesses has consequently plunged at its fastest rate in nearly three years, a sentiment exacerbated by wider economic uncertainties. Global headwinds, including US tariffs, their impact on international trade, and ongoing conflicts in the Middle East, are causing many businesses to put major investment decisions on hold. Alpesh Paleja, the CBI’s deputy chief economist, encapsulated the mood, stating that "conditions deteriorated" across the sector and that firms "still expect to cut back on hiring and investment going forward." He emphasized the need for reassurance from the Chancellor's upcoming Mansion House speech and the autumn budget, particularly regarding the equitable distribution of potential tax burdens.

A Shift in Investment Focus: The UK's Unexpected Allure?

Adding another intriguing layer to the complex picture of the UK's economic future is a recent Deloitte survey of chief financial officers (CFOs) at major British firms. While the CBI paints a grim domestic employment and investment picture, Deloitte's findings suggest a significant re-evaluation of international investment attractiveness.

Strikingly, the appeal of the United States as an investment destination has plummeted in the eyes of British business executives. A net balance of only +2% of respondents now see the US as attractive, a drastic fall from +59% in late 2024, a period preceding significant policy shifts in the US. This aligns with official US data showing a sharp drop in inward foreign direct investment in early 2025, coinciding with heightened business uncertainty over tariff plans.

Conversely, British company executives are surprisingly warming to their own market. The balance for the UK as an attractive investment destination surged to +13% from -12%, placing it on par with India as a top choice. While still trailing the US in overall attractiveness, the UK's newfound appeal is a notable shift. Richard Houston, senior partner and chief executive of Deloitte UK, welcomed this "renewed confidence," seeing it as an indicator of the "considerable investment potential the UK offers."

Navigating the Future: Challenges for the Chancellor

These contrasting survey results paint a nuanced yet challenging picture for the future of the UK economy. On one hand, the financial sector's cautious outlook on jobs and investment suggests a period of contraction and belt-tightening is imminent. This presents a formidable challenge for the government, particularly for Finance Minister Rachel Reeves, who is widely expected by markets to consider further tax rises in the next budget. Weak economic growth, as generally indicated by current British business surveys, will make such fiscal decisions even more politically and economically sensitive.

On the other hand, the Deloitte survey's revelation of increased domestic investment appetite offers a glimmer of hope. If this sentiment translates into tangible investment, it could provide a much-needed boost to the UK economy. However, the critical question remains: will this newfound domestic confidence be enough to offset the broader uncertainties, global headwinds, and the financial sector's pessimistic outlook?

The coming months will be crucial. The Chancellor's upcoming speeches and the autumn budget will be under intense scrutiny as businesses seek clear signals and reassurances on economic stability, regulatory predictability, and a fair tax burden. The delicate balance between fiscal responsibility, fostering business confidence, and navigating a complex global landscape will ultimately determine the trajectory of the UK's economic future. The stage is set for a period of significant decision-making that will shape the nation's prosperity for years to come.

.svg)

_5.jpg)