A new analysis reveals that middle-class workers are shouldering the heaviest tax burden due to a stealth raid on income thresholds, a policy that has simultaneously prompted a growing number of wealthy individuals to leave the UK. This economic shift, driven by a series of frozen tax thresholds, is creating a "fiscal drag" that pushes more people into higher tax brackets even as their incomes barely keep up with inflation, Daily Dazzling Dawn understands.

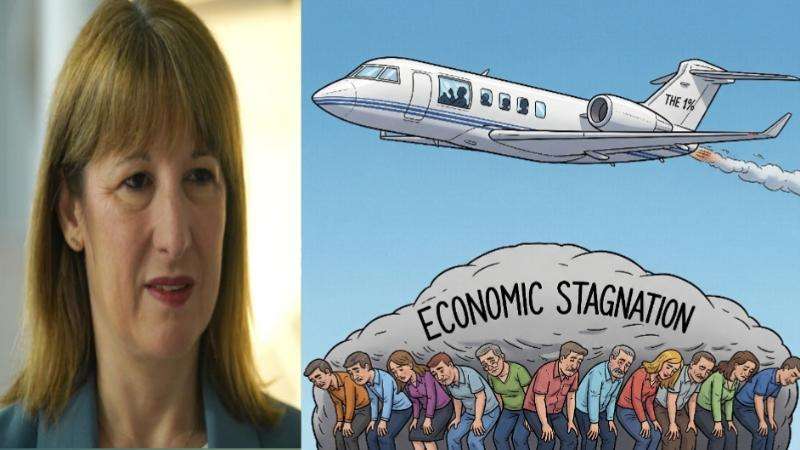

According to a report from the TaxPayers’ Alliance, the share of income tax paid by those earning between £43,000 and £61,900 has risen from 15.1% to 17% between the 2021-22 and 2025-26 tax years. During the same period, the share of income tax paid by the top 1% of earners—those making over £201,000 annually—has fallen from 30.7% to 26.6%. This trend is particularly impactful for thousands of British Bangladeshi, British South Asian, and other BAME community members.

The policy of freezing income tax thresholds, including the £12,570 tax-free personal allowance, was first introduced by former Chancellor Rishi Sunak and later extended by his successor, Jeremy Hunt. The current government has yet to reverse this, and the opposition leader, Sir Keir Starmer, has not ruled out extending the freeze further. This fiscal drag is projected to be significant, with almost 2.9 million more people paying the basic rate of income tax and over 2.6 million more paying the higher rate by 2025-26 compared to 2021-22. In total, nearly 6 million more people are forecast to be paying income tax than in 2021-22.

This situation comes as the current Chancellor, Rachel Reeves, faces a significant £51.1 billion deficit. This fiscal hole is being made worse by an exodus of high-net-worth individuals. Analysis by the Financial Times shows a 40% increase in company directors moving abroad since the government’s autumn budget, which included measures like the abolition of non-dom status and tighter inheritance tax rules. Notable figures who have left include Goldman Sachs’s Richard Gnodde and Aston Villa co-owner Nassef Sawiris.

John O’Connell, chief executive of the TaxPayers’ Alliance, describes the situation as a "doom loop" where the government's desperate search for cash pushes away the very people who contribute the most in tax, ultimately forcing a greater burden onto the middle class. Experts like Laura Suter of AJ Bell warn that future tax-raising measures could further exacerbate this trend, making middle earners responsible for an increasing proportion of the nation's tax bill. Despite the Treasury’s insistence that its "Plan for Change" will protect working people and its promise not to raise key tax rates, critics argue that the policy of frozen thresholds remains a major issue.

_3.jpg)

.svg)