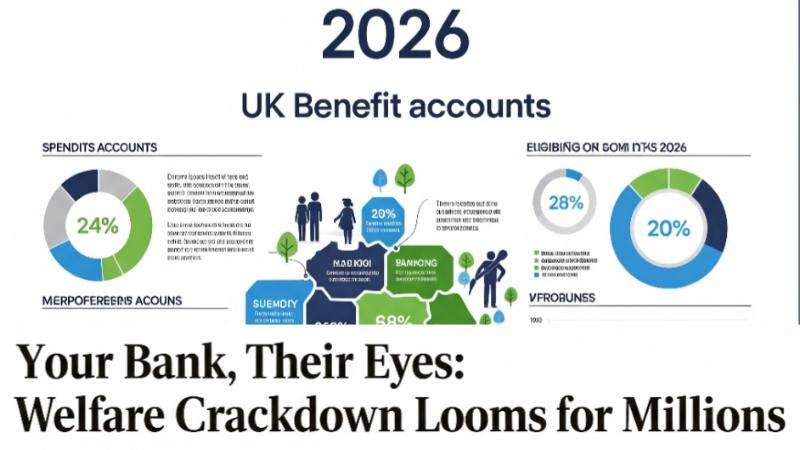

City corporations have urged Rachel Reeves to decrease tax advantages for millions of small investors in cash Isas in order to improve the UK economy.Financial firms have informed the Chancellor that the £300 billion owned by Britons in cash Isas might offer higher returns for savers if they chose riskier stocks and shares Isas, while also benefiting businesses. Isas have transformed the savings industry since their introduction by Gordon Brown in 1999. According to the latest numbers, 12.4 million adults signed up for an Isa in 2022/23, a significant increase from 11.8 million the previous year.This increase was driven by people putting more into cash Isas, where the amount saved went up by £10.7 billion.

The topic is said to have been discussed at a recent meeting between finance executives and Reeves, who did not dismiss the idea outright, according to one senior banker.Andy Briggs, CEO of insurance group Phoenix, was also at the meeting and told the Financial Times: ‘It’s not the state’s role to provide a tax break for simply parking money in cash.’

He added: ‘I’m hopeful Rachel Reeves will see the sense in refocusing Isa tax incentives to align with the Government’s broader economic growth strategy.’Due to a perception of greater safety, many Britons prefer to keep their money in cash as opposed to investing in stocks – and cash Isas allow savers to earn tax-free interest on up to £20,000 every year. The UK offers various types of Isas, but the financial services industry is concerned that too much money is being funnelled into cash deposits when it could be more productive if it were invested in UK companies.

One Treasury official being lobbied on scrapping cash Isas by City firms said: ‘They say there is a huge amount of capital that could be doing much more.’

But while the possibility is still under consideration, Reeves is understood to be reluctant to change such a widely used form of savings.

A Treasury spokesman said: ‘We want to help people save for their future goals. We keep all aspects of savings policy under review.’

.svg)