Nearly a year after a seismic student-led revolution toppled Sheikh Hasina's autocratic government in Bangladesh, plunging the nation into political and economic turmoil, an unsettling reality is crystallizing in the United Kingdom. Luxurious Knightsbridge townhouses and sprawling Surrey mansions are increasingly becoming central figures in a burgeoning international anti-corruption drive, intrinsically linked to a concerning influx of former Bangladeshi political figures now seeking refuge or establishing residence in Britain, Daily Dazzling Dawn understands.

Investigations in Dhaka, the Bangladeshi capital, allege that powerful and politically connected individuals from the previous Hasina regime exploited their senior positions, orchestrating widespread looting of state contracts and manipulating the banking system. Millions of pounds, it is claimed, were then illicitly funnelled into high-end UK property.

A Growing Exodus to British Shores

Amidst the ongoing turmoil and the global pursuit of alleged ill-gotten gains, sources indicate that at least three former ministers from Sheikh Hasina's government have sought and reportedly been granted asylum in the UK. This significant development underscores a worrying trend. Furthermore, reports suggest that at least four other former Members of Parliament (MPs) from the ousted Awami League are now residing in Britain, navigating the complex UK immigration system. Their presence here is raising eyebrows and prompting serious questions about London's role as a convenient haven. Persistent rumours circulate within Bangladeshi diaspora communities and political circles that a substantial number of former Awami League leaders and their associates invested vast sums of money in UK properties, often using different people's names or intricate shell company structures to obscure true ownership.

Britain's Response: Freezes and Investigations

Britain's National Crime Agency (NCA), often dubbed the UK's FBI, has already initiated significant action. In May 2025, the NCA froze £90 million of property belonging to members of the powerful Rahman family, whose extensive UK real estate portfolio has drawn scrutiny. This was swiftly followed, just three weeks later, by a much larger seizure: an astonishing £170 million in assets linked to Saifuzzaman Chowdhury, a former land minister in the Hasina government. Chowdhury reportedly amassed a vast fortune during his tenure, including an empire of over 300 UK properties, ranging from apartments to lavish townhouses, despite officially declaring no foreign income. Al Jazeera reports that Chowdhury's luxury home in St John's Wood, London, is specifically part of this asset freeze, and that three of his London property companies have also entered administration. In total, the NCA has confirmed freezing 342 properties with a combined purchase price of £185 million linked to Chowdhury.

However, a new joint investigation, conducted by collaborating journalists and the campaign group Transparency International, has unearthed disturbing evidence that several Bangladeshis currently under scrutiny in Dhaka appear to have been actively selling, transferring, or refinancing their UK properties since the revolution began. These transactions raise critical questions about the effectiveness of current measures and the due diligence performed by the UK law firms and consultants who facilitate such deals.

Dhaka's Urgent Plea for Greater UK Action

Leading figures within Bangladesh's interim government are now urgently appealing to Britain to exercise greater caution and intensify its efforts. Speaking from the prestigious Dorchester Hotel in London, Muhammad Yunus, the interim premier, led a delegation in early June on a mission to forge stronger ties and, crucially, secure UK support in tracking and repatriating allegedly laundered assets.

Ahsan Mansur, Bangladesh's central bank governor, stressed the urgency of the situation: "We are aware of efforts to liquidate assets and we would like the UK government to consider more freezing orders." His call was echoed by Mohammad Abdul Momen, Chair of Bangladesh's Anti-Corruption Commission (ACC), who last month specifically requested the NCA to consider freezing assets of several more individuals amidst a flurry of post-revolutionary property market activity.

Suspicious Activity on the Land Registry Unmasked

Disclosures to the UK Land Registry reveal at least 20 "applications for dealing" submitted in the past year concerning properties owned by figures under Dhaka's scrutiny. These documents typically indicate a sale, a transfer of ownership, or a change to a mortgage, suggesting attempts to divest or restructure assets.

Among prominent cases, the Sobhan family, linked to the Bashundhara business group, saw three applications related to £24.5 million worth of property. One four-storey Knightsbridge townhouse was allegedly transferred for no charge in April 2024 to a UK business linked to a firm that previously advised the Sobhans, then reportedly sold for £7.35 million to a newly formed company whose sole director is an obscure accountant linked to multiple high-value London properties.

Anisuzzaman Chowdhury, brother of the former minister Saifuzzaman Chowdhury, has also been involved in multiple property deals. Land Registry data shows recent activity on four of his properties, including the sale of a £10 million Georgian townhouse near Regent’s Park in central London, completed in July 2024. His lawyers claim this sale was agreed upon in 2023, prior to the revolution.

Furthermore, three more applications for dealing concern properties owned by Ahmed Shayan Rahman (son) and Ahmed Shahryar Rahman (nephew) of Salman F Rahman, who runs the massive Beximco business group. These properties, including a £35 million apartment in Mayfair’s prestigious Grosvenor Square, were among those frozen by the NCA in May 2025.

Lawyers for the Rahman and Anisuzzaman Chowdhury families deny any wrongdoing, attributing the allegations to "political upheaval" in Bangladesh and stating their clients will cooperate with UK investigations. The ACC, according to reports, is also investigating whether Chowdhury assisted a London-based property developer (who denies wrongdoing and faces a travel ban in Bangladesh) in obtaining irregular loans.

London's "Dirty Money" Reputation Under Scrutiny

Joe Powell MP, chair of an all-party parliamentary group examining corruption and tax, urged swift action, warning: "History tells us that assets can quickly evaporate unless swift steps are taken to freeze those assets while investigations are under way." He welcomed the NCA's actions but pressed for an expansion of their efforts, particularly given London's renewed focus on combating suspicious funds in the wake of Russia’s invasion of Ukraine.

Transparency International is raising pointed questions over the role played by multiple UK firms, including law firms like Jaswal Johnston and Merali Beedle, which have acted for individuals now targeted by the NCA or named by the ACC. A Transparency International spokesperson emphasized that "Professional services firms should exercise extreme caution when conducting regulated activities for clients known to be under investigation. They should perform comprehensive source-of-wealth checks and immediately report suspicious activity to police." Without such vigilance, they warn, these funds risk "vanishing into the international financial system, potentially placing them beyond recovery."

The ACC has declined to comment directly on its ongoing investigations. However, the assertive actions taken by the NCA, coupled with the mounting pressure from Bangladesh's interim government and the revelations about former ministers and MPs seeking refuge in the UK, signal a concerted push to hold allegedly corrupt figures accountable and repatriate stolen wealth from the UK's lucrative property market. The coming months will determine if London can truly shed its reputation as a safe haven for illicit fortunes and become a resolute partner in the global fight against corruption.

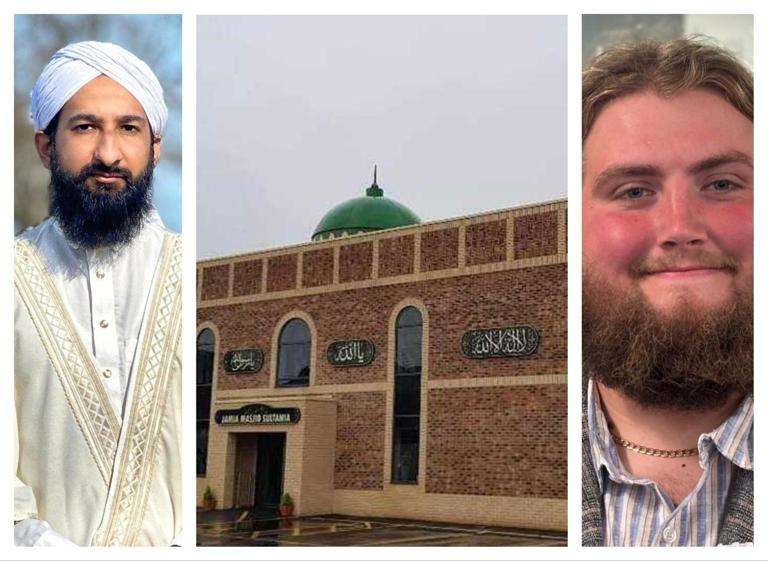

_9.jpg)

.svg)

.jpg)