Shaun Whitehouse is not looking forward to 2025.

This year, the manager of the Lanes Hotel near Yeovil turns 60, but he says there isn't much to celebrate.

This is because his tax burden will increase by about £60,000 as a result of Rachel Reeves's £25 billion National Insurance raid on employers.

Whitehouse, who has ran the hotel for ten years, adds, "We operate on wafer-thin margins." There are only two ways to really find the money, so you don't need to be a genius to figure it out. One is by making cuts, and the other is by raising revenue.

“With consumer confidence the way it is at the moment, it’s unlikely that we’re going to be able to increase volume. In fact, I see it probably going backwards. So I’m left with price rises, which is only going to fuel inflation.”

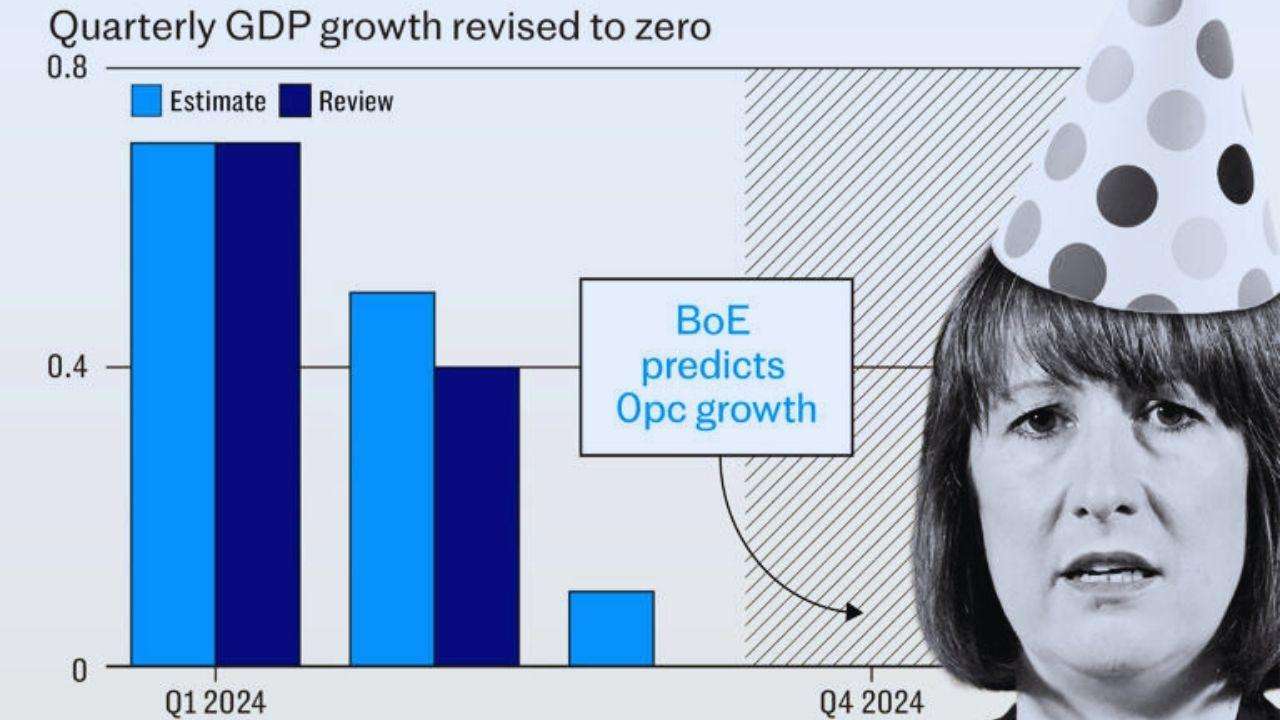

Labour has left Britain on the brink of recession after the Chancellor spent months talking down the economy and imposed £40bn of tax rises to fund an increase in the size of the state.

So far the main damage has come from a slump in confidence and higher borrowing costs to head off a possible jump in inflation.

But in 2025, the impact of Labour’s actions will really start to be felt.

‘Tsunami of costs’

The £40bn bill will in large part be borne by private sector bosses such as Whitehouse, who employs 35 staff. He was hoping to add two more in 2025, in plans that included one full-time and one part-time member.

That has now gone out the window.

“I’ve had to cut one position already,” he says, with Ms Reeves’s Budget “crystallising my decision”.

“It was a new position we were going to create because despite everything I’ve just said, I am looking hopefully this year to see some growth because there is a major contract coming up in the local area.

“But now, even if we win this contract, I don’t think I can take anyone on.”

Kate Nicholls, chief executive of the trade group UKHospitality, says businesses in her industry are already slashing jobs, investment and raising prices in the face of a “tsunami of costs” triggered by the National Insurance raid.

“These decisions were taken the day after the Budget. It is such an economic shock to our sector that no business is immune from having to make some really difficult decisions,” she says.

The trade body has already warned of £3.4bn in extra costs from April.

“85pc of our businesses say they are cutting staff hours or headcount, 95pc say they are cutting investment, and 97pc say they are putting up prices, Ms Nicholls says.

“They’re already making those plans.”

Ms Nicholls says the Budget destroyed what had been nascent optimism in the sector.

“This was the first year that we looked ahead and could see some signs of growth and recovery. We had green shoots,” she says.

“Those have just been dashed, and that hope and optimism just been dashed by the £3.4bn tax take that the Government is imposing on our sector.

“I don’t think they realise yet the real world consequences that it will have in the new year with a knock-on impact on the Government’s ability to achieve their ambitions, on gross jobs and investment.”

Whitehouse agrees that all investment is on hold.

“We’ve got 30 bedrooms and we were going to upgrade them in tranches of 10,” he says.

“We had planned to start in January or February – which are quiet months for us to completely redo those bedrooms and bring them up to a higher standard. That’s now being shelved.”

Whitehouse, who started his career in hospitality straight out of school, says the environment he faces today is “as tough as I’ve ever known”, adding: “This is tougher than Covid.”

He adds: “When I first came into our industry and progressed on to a management training programme, we were taught that a wage percentage of around 25pc of turnover [was the right balance]. Most people I speak to now are happy if they can get their wage percentage under 40pc.

“What customers don’t realise is that for every pound they spend with us, about 40pc is going just to wages.”

That proportion is likely to increase further under Labour, with the minimum wage rising by 6.7pc in April to £12.21. For 18, 19 and 20-year-olds, the increase will be much steeper, with the current rate of £8.60 rising to £10 an hour – a 16pc increase year on year.

That is the largest rise on record and comes as the Government prepares to unleash a wave of workers’ rights reforms that employers say will exacerbate Britain’s worklessness crisis.

More pain to come

Higher taxes and wages can fuel price rises, forcing the Bank of England to keep interest rates higher for longer to prevent the economy from overheating.

Rob Wood, chief UK economist at Pantheon Macroeconomics, expects tax hikes and government spending to push inflation above 3pc in spring, which will force Andrew Bailey, the Bank’s Governor, to write a letter to the Chancellor explaining why inflation is more than a percentage point above its 2pc target.

Investors, meanwhile, are only pricing in two interest rate cuts in 2025. Just before the Budget, they were predicting at least four.

This has far-reaching implications for the growth and the private investment the Chancellor so badly craves.

Tim Sarson, head of tax at KPMG, says many of his multinational clients are “cross” about the National Insurance increase that he said came as a “shock” to the big employers he works with.

But, he adds, many of them believe Reeves is far from done with her tax raids.

“There’s an assumption among a lot of them that she’ll be back for more,” he says.

“You only need to look at history where generally a new government often comes back a couple of times [to raise taxes] early on in the parliament. And then of course they do giveaways later on.”

But by then, he says, it may be too late to lift the economy as the Budget continues to have a chilling effect on investment plans.

Sarson adds: “Unfortunately, I think the vibes about growth are ‘wait and see’. And ‘wait and see’ is quite a dangerous vibe, because if everyone’s waiting and seeing, then that means that everyone’s holding off on pressing the button on investment and spending.”

Whitehouse also expects the disappointment to continue.

“I think a lot of us feel duped,” he says. “Labour said in their manifesto they wouldn’t be putting up National Insurance. Of course, stealthily, they have done that because they played with semantics.

“I think there’s also a lot of buyer’s remorse. There’s a feeling – and it’s growing – that what we were sold in the run-up to the election is not what’s being delivered.”

He also regrets that higher costs are likely to pave the way for more automation, although he’s determined to resist any such move at his hotel.

“I’ve got a great team here. We’ve had the hotel for 10 years, but I’ve got staff with 20 years’ service. We have a very low turnover. We rarely look for staff. We run it as a family, but it’s going to be tough.”

For many in the industry, an unhappy new year lies ahead.

.svg)