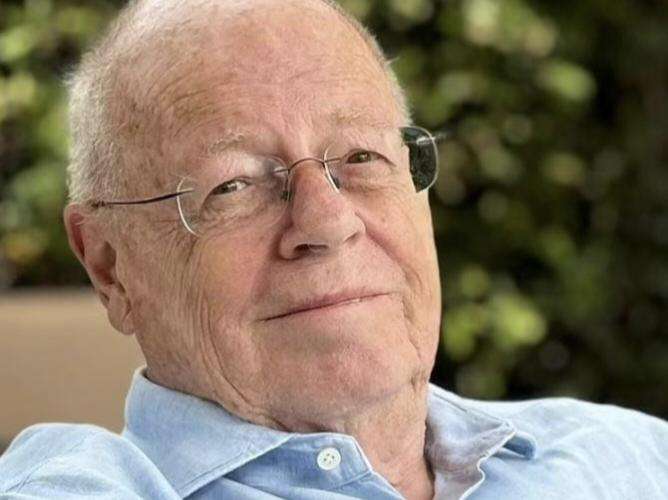

Global investors have placed Britain on "suicide watch" due to growing worries about the country's soaring public debt, former Treasury minister Lord Agnew has warned.

According to the Tory peer, the UK could be in danger of receiving an IMF bailout similar to that of 1976, especially in light of recent hikes in borrowing costs following Rachel Reeves' Budget.

The Chancellor's expenditure plans have been disrupted by the skyrocketing yields on government bonds, which, despite a little decline, are still close to their highest levels since 1998.

"The public markets are saying: 'You're on suicide watch, we're watching you carefully,'" Lord Agnew told The Telegraph.

Economists predict the latest rise in gilt yields will add approximately £8billion to the Government's debt interest bill, according to Capital Economics.

Official figures reveal gross UK Government debt has grown dramatically from £737billion in July-September 2008 to £2.84trillion between October and December.

This represents a more than doubling as a share of the UK economy, rising from 46.3 to 101.7 per cent of GDP.

The surge partly reflects spending responses to both the financial crisis and Covid pandemic.

And Lord Agnew has blamed "civil service incompetence" for much of the country's spiralling debt.

The former minister calculated that while financial crisis and Covid spending should account for £550billion in borrowing, this leaves around £1.5trillion unaccounted for.

"If you look at where the money has been spent, it has just been spent so badly," he said.

He claimed the problem partly stems from civil servants being too difficult to dismiss, saying it would be "easier for me to win the lottery".

Lord Agnew pointed to HS2 as an example of wasteful spending, where tens of billions were splurged before its northern leg was scrapped in 2023.

And even Labour appears frustrated with the civil service, with Sir Keir Starmer warning that "too many people in Whitehall are comfortable in the tepid bath of managed decline".

Lord Agnew did, however, praise Reeves's recent decision to water down her non-dom tax raid, announced at the World Economic Forum last week.

"Imagine how hard it is for a socialist government to relax rules on non-doms," he said.

Looking ahead, Lord Agnew urged the Chancellor to follow Donald Trump's approach by rolling back net zero targets for electric cars.

He also warned against relying on regulators to drive growth.

"Someone who makes a career as a regulator is someone who is risk-averse, lacks imagination and doesn't understand wealth creation," he said.

"It is bizarre, frankly, that she should go to these people. It's a bit like going to a fox and saying 'How can you kill a few fewer chickens?'"

_7.jpg)

_9.jpg)

.svg)