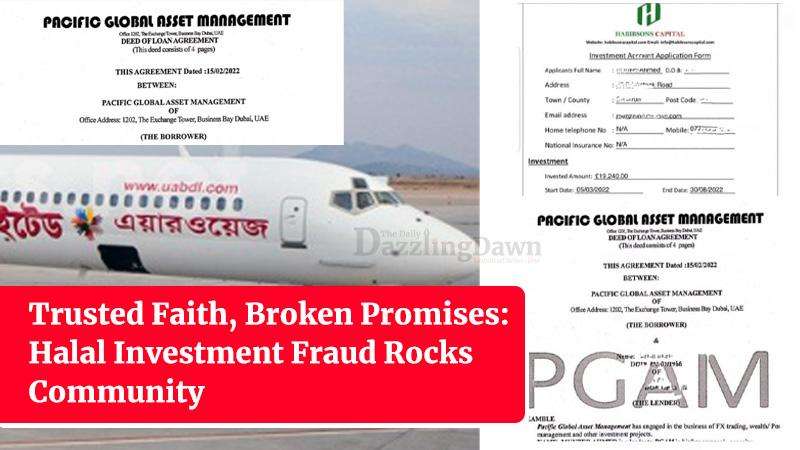

A wave of shock and anger has swept through the British Bangladeshi, British Muslim and British Asian community following allegations that billions of pounds, invested in purportedly halal ventures like airlines, shipping businesses, and investments like Habib son's capital, have been lost in a massive fraud. Thousands, seeking ethical investment opportunities, now face financial ruin, their trust betrayed. Thousands of investors invested their life savings, and women sold their jewelry to them, because they said it was completely halal. People sold their houses and businesses to invest with the fraudsters, Daily Dazzling Dawn understands.

Untapped Potential: Multi-Million Pound Halal Investment Market Slipping Through Western Fingers

A significant, yet largely overlooked, investment opportunity is being squandered across the UK, Europe, and America: the burgeoning halal finance market. While demand from the growing Muslim population for ethical, Sharia-compliant investments surges, a lack of awareness and tailored financial products is leaving billions of pounds of potential capital unrealized.

The halal finance sector, which adheres to Islamic principles prohibiting interest (riba) and investments in non-permissible industries (haram), has witnessed exponential growth globally. However, in Western markets, where Muslim communities represent a substantial demographic, the sector remains underdeveloped.

There's a clear disconnect between the demand and the supply," explains financial analyst, Aisha Khan, speaking at a recent Islamic Finance conference in London. "Muslims in the West are increasingly seeking investment options that align with their faith, but they are often met with limited choices or a lack of understanding from mainstream financial institutions."

Missed Opportunities

Real Estate: Demand for Sharia-compliant mortgages and property investment funds is high, but availability is scarce. This restricts Muslim homeownership and investment in a lucrative sector.

Ethical Stocks and Funds: While some ethical investment funds exist, many do not fully comply with Sharia principles. The market lacks specialized halal equity funds and Islamic venture capital.

SME Financing: Muslim-owned small and medium-sized enterprises (SMEs), a vital part of the Western economy, often struggle to access Sharia-compliant financing, hindering their growth potential.

Lack of Education: Many financial advisors lack the necessary knowledge and training in halal finance, leading to miscommunication and missed opportunities.

The Economic Impact

The underdevelopment of the halal finance sector has significant economic implications. Billions of pounds in potential investment capital are being left untapped, hindering economic growth and depriving Muslim communities of financial empowerment.

"This isn't just a religious issue; it's an economic one," states Dr. Yusuf Patel, an economist specializing in Islamic finance. "By failing to cater to the halal investment market, Western economies are missing out on a significant source of capital and a growing customer base."

Calls for Action

Experts are calling for increased awareness and education about halal finance, as well as the development of tailored financial products and services. They urge mainstream financial institutions to recognize the potential of this market and to invest in developing Sharia-compliant offerings.

"It's time for the financial industry to wake up to the potential of the halal finance market," says Khan. "By embracing ethical and faith-based investing, they can unlock a new source of growth and contribute to a more inclusive and equitable financial system."

The Path Forward

The development of robust regulatory frameworks, the establishment of dedicated halal finance institutions, and the promotion of financial literacy within Muslim communities are crucial steps towards realizing the full potential of this market.

As the Muslim population in the West continues to grow, the demand for halal investment will only increase. By addressing the current gaps in the market, Western economies can unlock a significant source of growth and foster greater financial inclusion.

.svg)