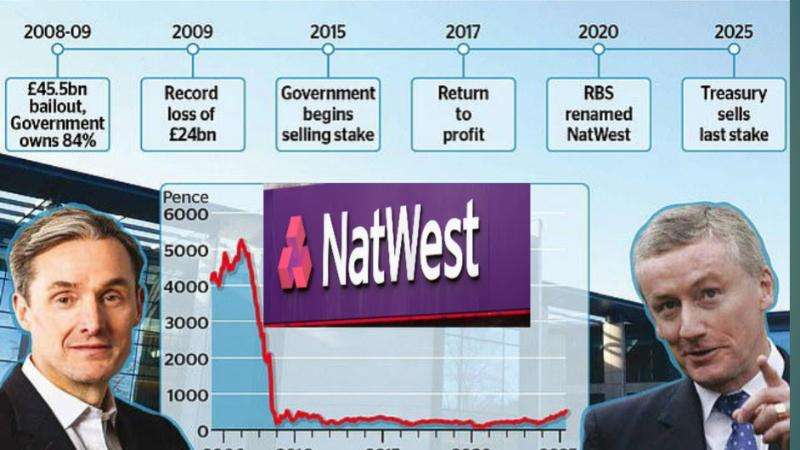

The UK Government has officially ended its 17-year ownership of NatWest, selling its final tranche of shares and drawing a line under one of the most dramatic interventions of the 2008 financial crisis. The Treasury's disposal of the remaining stake, valued around £200 million, signifies the complete return of the bank, formerly Royal Bank of Scotland (RBS), to private hands, nearly two decades after a colossal £45.5 billion taxpayer-funded bailout saved it from implosion, Daily Dazzling Dawn understands.

The driving force behind the final sale, according to government sources and economic analysts, is multi-faceted. Primarily, it marks a symbolic closure of a "troubling chapter" in British economic history. Chancellor Rachel Reeves hailed the move, stating, "NatWest's return to private ownership turns the page on a significant chapter in this country's history." She reaffirmed that the initial 2008 bailout under Gordon Brown's Labour government "protected the economy" by preventing a systemic collapse during the financial crisis, deeming it "the right decision."

Another key reason for the divestment is to signal the restored stability and health of NatWest and the broader UK banking sector. Successive governments have aimed to gradually reduce the state's holding as the bank recovered, demonstrating confidence in its independent viability. This final sale is the culmination of that long-term strategy, aiming to reduce state intervention in the commercial banking sector and return NatWest to operate entirely under market disciplines. Last summer, the government still held a 20% stake, which has been incrementally reduced through a "drip-feed" of shares onto the market.

The move also aligns with a broader fiscal objective of recouping taxpayer money, although the rescue has ultimately come at a considerable cost. While the Treasury has recovered approximately £35 billion through share sales, dividends, and fees from its £45.5 billion outlay – a headline loss of £10.5 billion – figures from the Office for Budget Responsibility indicate the true cost to the taxpayer is nearer £30 billion when financing costs are factored in. Despite this, a Treasury spokesman defended the original bailout, emphasizing, "Allowing the bank to fail would have devastated people's savings, mortgages and livelihoods – and shattered confidence in the UK's financial system."

The bailout was a consequence of a period of aggressive expansion under then-CEO Fred 'The Shred' Goodwin, notoriously including the ill-fated acquisition of Dutch lender ABN Amro in 2007. This made RBS, briefly, the world's largest bank before its near-collapse. Goodwin was subsequently removed, and later stripped of his knighthood, though he reportedly still receives substantial pension payments.

NatWest, which rebranded from RBS Group in 2020 to distance itself from the crisis-laden past, has navigated further controversies, including settling claims it deliberately crippled struggling businesses for asset acquisition and the 2023 resignation of CEO Dame Alison Rose following a de-banking row with Reform UK leader Nigel Farage. Paul Thwaite now leads the institution.

NatWest Chairman Rick Haythornthwaite expressed gratitude: "We remain deeply grateful to the Government – and to UK taxpayers – for their intervention and support. This intervention stabilised our banking system and, by extension, our economy – protecting millions of savers, homeowners and businesses."

The sale of the government's final stake in NatWest follows a similar trajectory to that of Lloyds Banking Group, where the last government shares were sold in 2017, bringing an end to another significant chapter of state support for the UK's financial institutions.

_3.jpg)

.svg)

_2.jpg)