In a coordinated effort aimed at combating illegal activities involving cryptocurrencies, authorities in southwest London recently carried out a significant operation. This initiative resulted in the seizure of seven cryptocurrency ATMs and the arrest of two individuals suspected of running an unregistered crypto exchange and engaging in financial crimes. The operation, conducted jointly by the UK Financial Conduct Authority (FCA) and the Metropolitan Police, underscores the seriousness with which such issues are being addressed.

The FCA highlighted that operating a crypto exchange or ATM without proper registration is illegal in the UK. All firms involved in these activities must comply with stringent anti-money laundering regulations, including thorough customer due diligence and source-of-funds checks. Therese Chambers, the FCA's executive director of enforcement and market oversight, emphasized that unregistered crypto machines facilitate criminal activities and that operators should expect severe consequences.

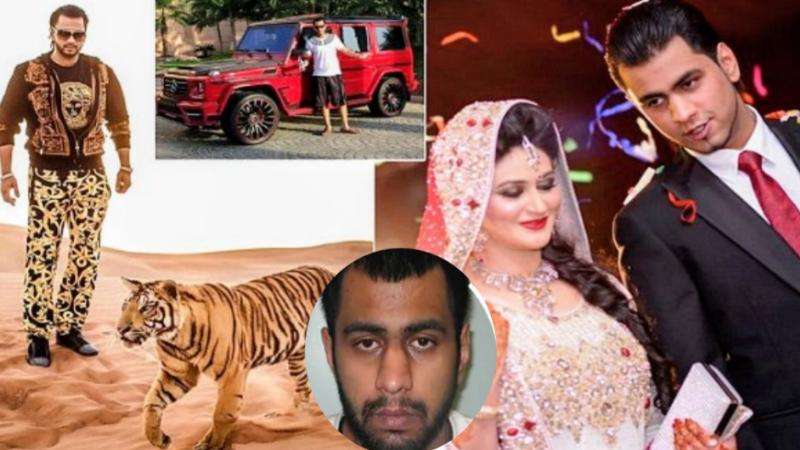

This action follows a previous case where Olumide Osunkoya was sentenced to four years in prison for operating a £2.5 million crypto ATM network through his company, GidiPlus. Despite being denied FCA registration, Osunkoya continued to operate using false identity documents and engaging in forgery and possession of criminal property. His machines were found to circumvent basic financial safeguards and charged markups of up to 60%.

The UK's stringent stance against illegal crypto ATM operations is part of a broader regulatory framework introduced since January 2021, requiring all crypto businesses to register with the FCA. The FCA serves as the anti-money laundering supervisor for crypto service providers and has consistently warned the public about the risks associated with unregulated crypto machines. This recent operation underscores the UK's commitment to ensuring that cryptocurrency activities adhere to legal standards, protecting investors and the financial system.

While the UK has taken a firm stance, other countries have adopted varying approaches to crypto ATMs. In the United States, for example, regulatory scrutiny is increasing, with some states imposing licensing rules and transaction caps, while others consider outright bans. New Zealand has implemented a complete ban, and Australia has tightened controls in response to fraud cases linked to Bitcoin ATMs.

The recent actions in the UK highlight the importance of compliance in the cryptocurrency sector and serve as a reminder of the potential consequences for non-compliance. As regulators continue to enforce regulations, it is crucial for crypto firms to adhere to legal standards and collaborate with regulators to ensure a secure and transparent financial environment. The UK's proactive approach reflects a commitment to harnessing the benefits of cryptocurrencies while safeguarding financial stability and security.

.jpg)

.svg)

_3.jpg)

_3.jpg)