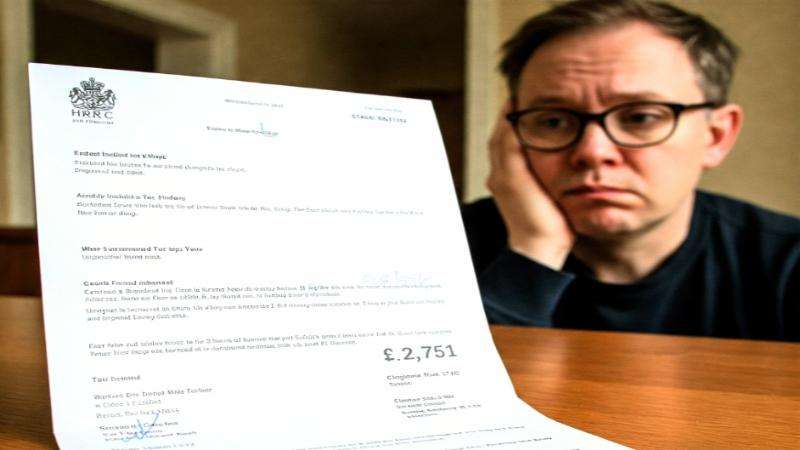

Fury is erupting amongst taxpayers, including significant numbers within the British South Asian, British Bangladeshi, British Muslim, and British Pakistani communities, after HM Revenue and Customs (HMRC) wrongly demanded a staggering £2,751 in tax payments. These alarming letters, landing on doorsteps nationwide, are based on the entirely false premise that recipients earned a colossal £14,000 in untaxed savings interest – a figure vehemently denied by many who insist they've never seen such returns.

The distressing impact of these erroneous demands is laid bare in the case of one taxpayer who sought the expertise of This is Money's Tony Hetherington. This individual received a shocking notification from HMRC claiming they underpaid tax in the 2022-2023 financial year due to supposedly earning over £14,000 in untaxed savings interest. The taxpayer, bewildered by the claim, stated unequivocally, "The savings figure was supplied to HMRC by National Savings. Unfortunately, I have no such account or interest. It is fictional."

Compounding the initial shock, the taxpayer's attempts to rectify the situation with the tax office led to further financial distress. They were informed that their Pay As You Earn (PAYE) tax code for their work pension was being drastically altered, resulting in a devastating £500 monthly reduction – effectively slashing their pension by approximately a third.

Responding to this injustice, tax expert Tony Hetherington highlighted the absurdity of the situation: "Your first inkling that anything was wrong came when you received a demand for £2,751, which was said to be tax due on interest of £14,750. All the taxman could tell you was that the figure had been supplied by National Savings, but officials there were no help either, as you could not give them the account number of the account you did not have in the first place."

Despite the taxpayer's clear communication with National Savings and Investments (NSandI) confirming they held no such account, HMRC inexplicably "changed tack and decided to collect an extra £500 a month from your pension." While HMRC staff initially offered assurances that the taxpayer wouldn't lose out in the long run if the NSandI tip-off proved incorrect, this provided little solace amidst the immediate and substantial cut to their pension for a phantom income.

The intervention of the media outlet finally spurred HMRC into action. Following contact from This is Money, the tax authority moved with "commendable speed." Just three days later, the affected taxpayer received an apology and an offer of a paltry £75 in compensation, along with a corrected PAYE code. The truly shocking outcome? Instead of owing a massive £2,751, the taxpayer actually owed a mere £1.80.

This case is far from isolated, with reports emerging from across the UK of similar erroneous demands landing on the doorsteps of countless individuals, including hardworking taxpayers from British South Asian, British Bangladeshi, British Muslim, and British Pakistani backgrounds. These communities, often diligent in their tax obligations, are now facing unnecessary anxiety, financial strain, and a profound lack of trust in the accuracy of HMRC's processes.

The implications of such widespread errors are significant. Not only do they cause immediate financial hardship and emotional distress to affected families, but they also raise serious questions about the reliability of HMRC's data handling and their ability to accurately assess tax liabilities. For communities who already navigate economic challenges, these unexpected and baseless demands can be particularly devastating.

The fact that HMRC initially based these demands on a fictional income figure and then proceeded to alter tax codes, directly impacting livelihoods, underscores a severe lack of due diligence. The small compensation offered in the featured case barely scratches the surface of the anxiety and potential financial disruption caused by HMRC's blunder.

As more stories of similar errors emerge, pressure is mounting on HMRC to urgently investigate the root cause of this widespread issue and implement robust measures to prevent future occurrences. For British South Asian, British Bangladeshi, British Muslim, British Pakistani, and all taxpayers caught in this bureaucratic nightmare, the priority is clear: HMRC must ensure accuracy, accountability, and a swift resolution to these unjust and deeply concerning demands. The trust between taxpayers and the tax authority is being eroded, and decisive action is needed to restore confidence in the system.

_3.jpg)

.svg)

_2.jpg)