A profound sense of apprehension is taking hold in boardrooms across the United Kingdom, as a new report reveals a stark increase in pessimism regarding both domestic and international economic conditions. Business leaders are battening down the hatches, anticipating a worsening financial climate amidst a backdrop of escalating global challenges.

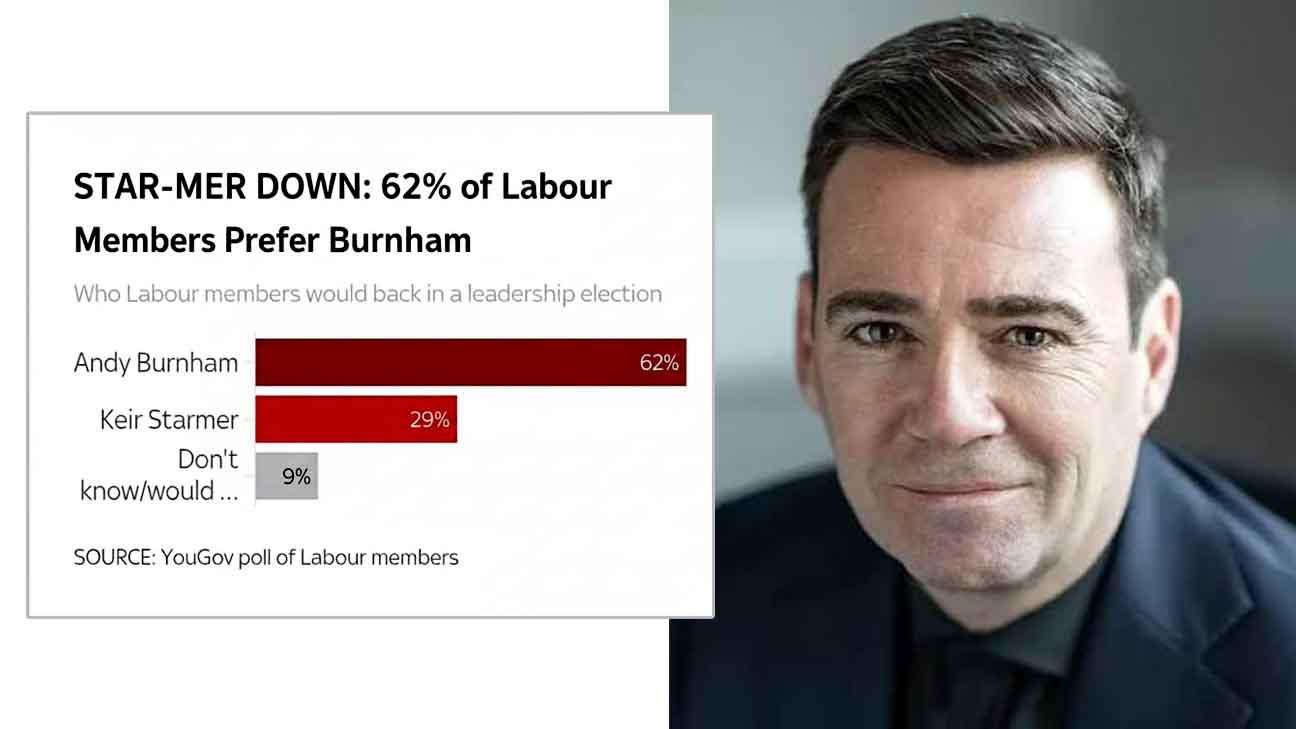

According to a comprehensive survey by The Chartered Governance Institute UK & Ireland (CGI), a staggering 70% of boardroom leaders expect global economic conditions to deteriorate in the coming year, with a mere 5.4% holding out hope for improvement. This represents a dramatic shift from 2024, when only 22.2% foresaw a decline and twice that percentage predicted an upturn. The domestic outlook is equally grim, with nearly two-thirds of respondents forecasting a further weakening of the UK's economic circumstances, a sharp contrast to just a quarter expressing similar concerns last year.

CGI's findings highlight deep-seated anxieties about the UK's competitiveness, exacerbated by external factors such as US trade tariffs and internal UK Government policy. The re-imposition of tariffs by President Donald Trump's administration, including a 10% baseline tariff on most US imports, a 25% import tax on car parts, and a 50% levy on foreign steel and aluminium, is casting a long shadow. These protectionist measures have ignited fears of slowing economic growth globally and within the UK, alongside intensifying inflationary pressures for both consumers and businesses. It is worth noting that while the US had briefly paused reciprocal tariffs for some countries, the general 10% tariff on most UK goods remains in effect as of June 2025, with investigations into further tariffs on sectors like semiconductors and pharmaceuticals ongoing. A recent UK-US trade deal aimed at mitigating some of these impacts has been announced, but its full effect is yet to be seen.

The prevailing caution is clearly impacting investment plans. Over a quarter of boardroom leaders indicated their firms intend to cut capital expenditure over the next year, with no respondents forecasting a "considerable" increase. This reluctance to invest signals a lack of confidence in future growth prospects and a prioritization of financial stability in an uncertain environment.

"The results remind us that boardroom decision-making has rarely been more challenging," stated the CGI report. "Organisations of every type are operating in a fluid, and often, hostile environment that (this year particularly) offers few certainties and elevated risk."

Beyond macroeconomic concerns, cybersecurity has emerged as the most pressing worry for boards, with 71% of governance professionals anticipating an increase in cyber risks this year. This is particularly concerning given that a smaller proportion of boards – 66% – intend to raise spending on IT security, a decrease from 80% in 2024/25. This disparity suggests a potential widening gap between perceived threat and actual preparedness. Globally, cybersecurity remains a critical issue in 2025, with a rise in AI-driven malware, more sophisticated targeted attacks, and concerns about the remote workforce expanding attack surfaces. Cybercrime is projected to cost the world $10.5 trillion annually by 2025.

Regulatory burdens also feature prominently among significant worries, with most governance professionals deeming existing rules "slightly excessive." This suggests a desire for a more streamlined and supportive regulatory landscape to foster business growth.

Peter Swabey, policy and research director at CGI UK & Ireland, commented, "Governance professionals, always in tune with board sentiments, reveal a boardroom mood of caution and recalibration. While AI and cyber resilience are climbing the agenda, confidence in the UK's economic outlook and regulatory environment remains fragile. The Government's industrial strategy will need to address these concerns if it is to unlock long-term investment."

UK Government's Industrial Strategy: A Glimmer of Hope?

In a crucial development, Britain's highly anticipated industrial strategy, originally slated for release this spring, is now set to be published in the last week of June. This 10-year, multibillion-pound strategy aims to boost growth, create jobs, and drive long-term economic prosperity by backing priority sectors. Key areas identified for focus within the strategy, as per the CGI survey, include defence, digital infrastructure, clean energy, and advanced manufacturing. The strategy is also expected to detail plans for the creative, financial services, life sciences, and professional and business services sectors. Recent announcements indicate a "10 Year Infrastructure Strategy" was published on June 19, 2025, as part of this broader industrial vision, pledging significant long-term funding for infrastructure projects and the renewal of public sector estates, signaling a government effort to provide certainty and attract investment.

The CGI survey, which underpins these findings, gathered full responses from 96 participants from organizations based in or operating in the UK. The responses were evenly split between governance professionals in private businesses and members of quoted firms (35% each), with the remaining 30% from representatives of the public sector, charities, and other ownership structures.

Broader Economic and Geopolitical Landscape (June 2025 Update)

UK Economy: The UK economy has shown a mixed picture recently. While GDP grew by 0.7% in Q1 2025, showing a stronger-than-expected start to the year, monthly GDP fell by 0.3% in April 2025. The services sector was a key driver of growth in Q1 but saw a decline in April. Production output also fell in April. Despite the Q1 rebound, experts suggest this growth is unlikely to be sustained, with weak labor market data and ongoing global uncertainties, particularly surrounding trade tariffs, posing significant headwinds. GDP per capita remains lower than pre-pandemic levels.

European Economy: Europe's economy shows resilience with low unemployment and inflation broadly at target, but faces mounting challenges. The IMF highlights trade tensions, rising demand for defense spending, and the need for energy security as key issues, alongside subpar productivity and an aging population. Modest recovery is projected for the euro area in 2025, with growth expected to rise from 0.7% in 2024 to 1.3% in 2025. Inflation remains a concern, particularly in services. The European Central Bank (ECB) has begun easing monetary policy, with further rate cuts anticipated in 2025. US tariffs are seen as a significant concern for the European economy, potentially reducing EU GDP growth.

World Economy: Global economic growth is experiencing a slowdown, with forecasts for 2025 significantly downgraded from previous projections. The World Bank projects global growth to weaken to 2.3% in 2025, with only a tepid recovery expected in 2026-27. This downward revision is largely attributed to a sharp rise in trade barriers and heightened policy uncertainty, leading to strained global supply chains. Developed economies are expected to see slower growth, and developing economies also face downgraded projections with significant regional disparities. Global inflation is projected to moderate, but downside risks persist, including escalating conflicts and extreme weather events.

Current War Situation and Economic Impact: The geopolitical landscape remains highly volatile, with ongoing conflicts and escalating trade tensions significantly impacting the global economic outlook. The war in Ukraine continues to exert inflationary pressures, disrupt supply chains, and contribute to energy insecurity, particularly in Europe. While specific daily updates on the Ukraine conflict are not detailed here, its broad economic ramifications, including commodity price volatility and humanitarian crises, are ongoing. Beyond Ukraine, other regional conflicts and heightened geopolitical uncertainty contribute to a less predictable environment for trade and investment. The threat of trade wars, particularly stemming from the "America First" rhetoric of President Trump's second term, casts a large shadow over global trade flows, potentially hindering overall economic growth. Businesses are facing higher costs due to tariffs and increased uncertainty, leading to reduced international trade and investment. The need for increased defense spending in many nations, driven by these geopolitical realities, also reallocates resources that might otherwise be used for economic development.

In conclusion, UK boardrooms are navigating a complex and increasingly challenging economic environment. The confluence of domestic concerns, global trade protectionism, geopolitical instability, and persistent cyber threats necessitates a cautious approach to investment and a clear, supportive industrial strategy from the government to foster long-term resilience and growth.

.svg)