China’s economy likely grew by over five percent in the second quarter, driven by robust export activity, according to analysts. However, they caution that escalating trade tensions with Donald Trump’s administration could lead to a sharp slowdown in the second half of the year.

The Chinese government is juggling multiple challenges in its efforts to maintain economic momentum, made more difficult by the U.S. president’s aggressive tariff measures. Since taking office in January, Trump has imposed trade duties on China and other key trading partners, threatening Beijing’s export-dependent recovery.

Although the U.S. and China recently made progress in easing tensions — reaching a preliminary deal during talks in London — experts remain wary of continued instability.

Official GDP figures due Tuesday will reveal how China performed between April and June, during a time when leaders aimed to cushion the economy from external shocks and boost consumer spending. Analysts surveyed by AFP expect a 5.2% year-on-year increase for the quarter, though many foresee weaker performance in the coming months.

“Exports alone aren’t enough to compensate for sluggish domestic demand,” said Sarah Tan of Moody’s Analytics. She added that without stronger policy measures and structural reforms to raise household income and confidence, China's recovery could further stall in the latter half of the year.

Exports Provide Temporary Relief

Recent data revealed consumer prices saw a modest rise in June, ending a four-month stretch of deflation. However, factory gate prices continued to slide — the producer price index fell 3.6% year-on-year, the sharpest drop in nearly two years.

“Deflationary pressures are still strong, and the job market remains underwhelming,” said Betty Wang of Oxford Economics, expressing caution about the outlook for the remainder of the year.

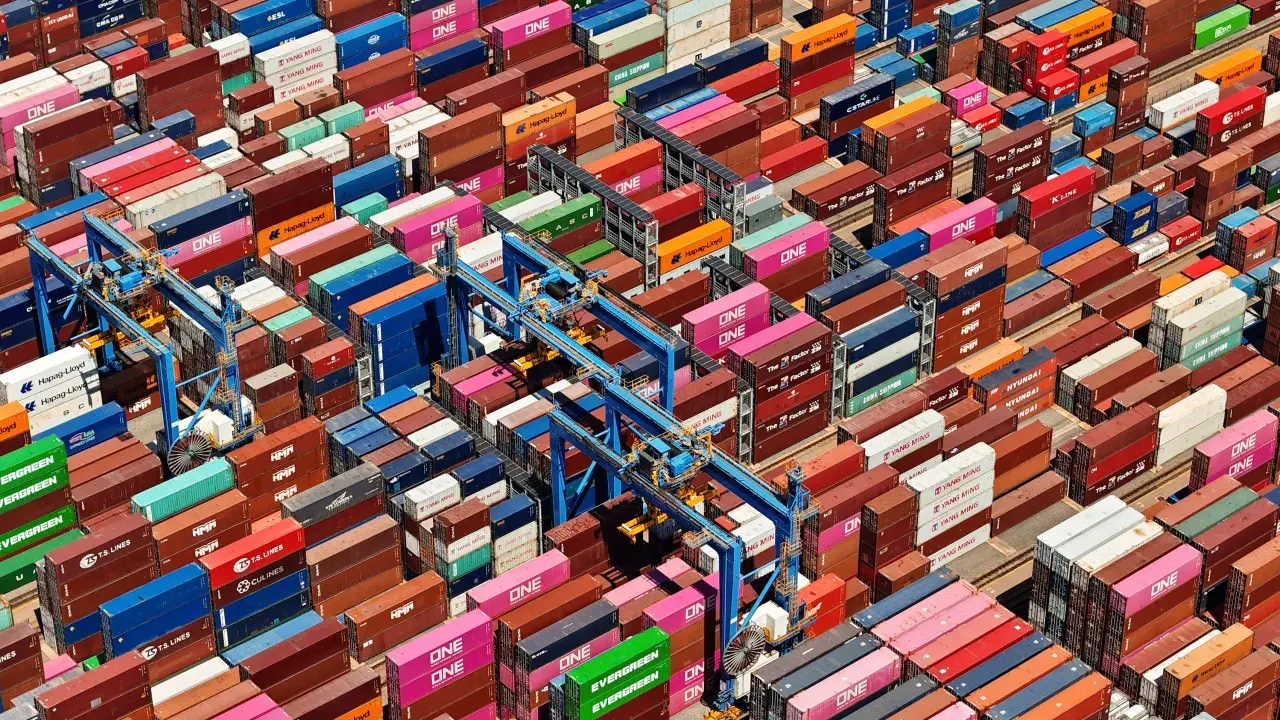

Exports have played a crucial role in stabilizing the economy, with foreign buyers rushing to place orders ahead of anticipated trade tensions. This frontloading effect led to a surge in overseas shipments during the second quarter.

“April was especially strong for exports due to the spike in U.S. import tariffs,” noted Alicia Garcia-Herrero, Chief Economist for Asia Pacific at Natixis. While the export boom improved growth forecasts for Q2, she warned that the rest of the year could see a notable decline.

Economists widely agree that China must pivot towards growth powered by domestic consumption, moving away from reliance on infrastructure, manufacturing, and export sectors.

Growth Without Gains

Beijing has launched various measures to stimulate spending, such as a subsidy program for trading in old consumer goods. However, Tan pointed out that these initiatives have not addressed deeper concerns, including slow income growth, job insecurity, and low consumer confidence.

China is aiming for around five percent growth for 2025 — the same goal as last year, though many analysts view it as ambitious. The economy grew 5.4% in the first quarter, surpassing expectations and providing a strong start to the year.

But according to economists Larry Hu and Yuxiao Zhang at Macquarie, this growth has been largely driven by exports and manufacturing, while domestic demand has remained weak. As a result, the growth has been “deflationary, jobless, and profitless,” they wrote.

China’s ability to hit its growth target depends heavily on how it manages its strained trade relations with the U.S. and whether it can introduce more aggressive stimulus measures like interest rate cuts to spur consumer spending.

Some experts warn that stronger-than-expected growth might make policymakers reluctant to undertake the deep structural reforms necessary for long-term sustainability.

“Without bold stimulus, it will be difficult to escape the ongoing deflationary cycle,” Hu and Zhang argued. Still, they noted that major policy moves are unlikely unless export performance significantly worsens, as authorities seem intent only on meeting — not exceeding — the five percent growth goal.

.svg)

.jpg)

_2.jpg)

_2.jpg)