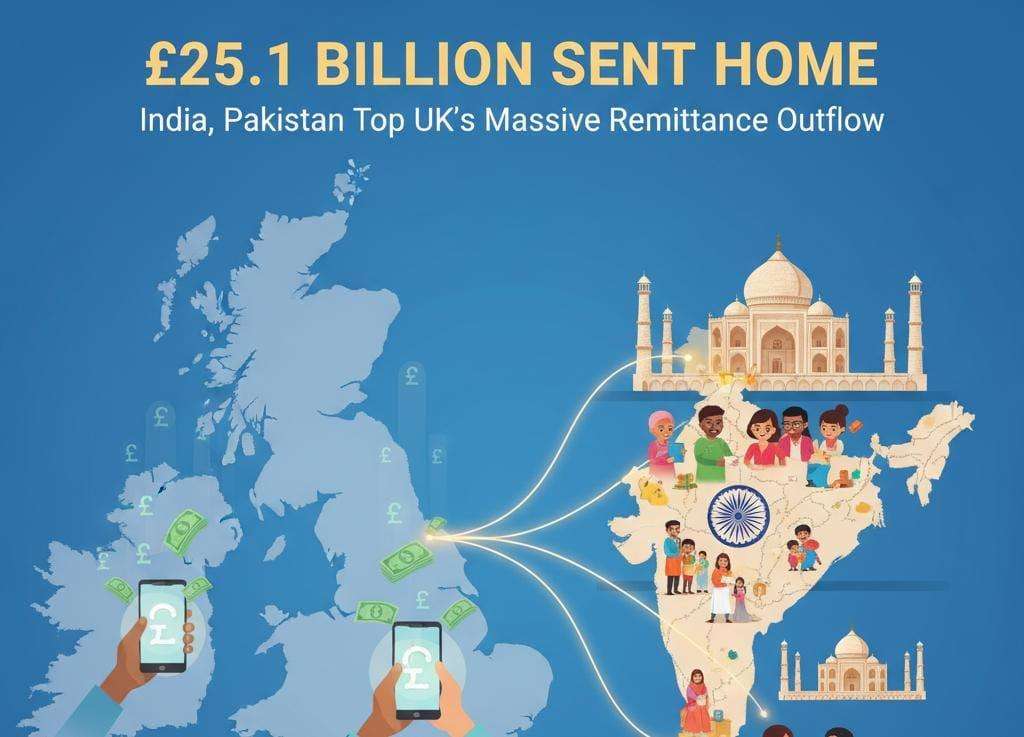

The immense financial contribution and global reach of the UK's immigrant communities have been brought into sharp focus by a striking analysis of international remittance data. Figures based on a World Bank model estimate that personal funds transferred out of the UK annually to the top 20 recipient countries total at least £25.1 billion (using data from 2021 or earlier).

The data, sourced from the discontinued World Bank Bilateral Remittance Matrix, provides a clear snapshot of the nations most heavily supported by UK-based migrants, despite the model being acknowledged as having been affected by the pandemic and showing remittances lower than in some previous years.

India, Pakistan, and Nigeria Lead Transfers

The three countries receiving the highest volume of transfers underscore the profound financial connections maintained by the UK's largest diaspora groups:

India: Tops the list, receiving an estimated £4.46 billion.

Pakistan: Follows closely with transfers reaching approximately £2.94 billion.

Nigeria: Ranks third, receiving an estimated £2.76 billion.

Bangladesh and the Wider Commonwealth Connection

The analysis also highlights the significant role of the Bangladeshi community in the UK. Bangladesh ranks 12th on the list, receiving a substantial £828 million (0.828 billion) in remittances. This figure places the financial impact of the British-Bangladeshi community above transfers to countries like Italy, Ghana, and Israel, reflecting the enduring ties between the UK and key Commonwealth nations.

Other major recipients include European partners like France (£2.46bn) and Germany (£1.67bn), as well as other Commonwealth nations like China (£1.37bn) and Kenya (£1.02bn).

While the World Bank has not released a Bilateral Remittance Matrix since 2021, meaning updated figures for 2022 onwards are unavailable, the scale of the pre-2022 data remains a crucial indicator. These remittances are vital economic forces, often serving as a primary source of income for families overseas, funding education, housing, and healthcare, and solidifying the UK’s role as a major hub for global financial circulation driven by its diverse population.

.svg)